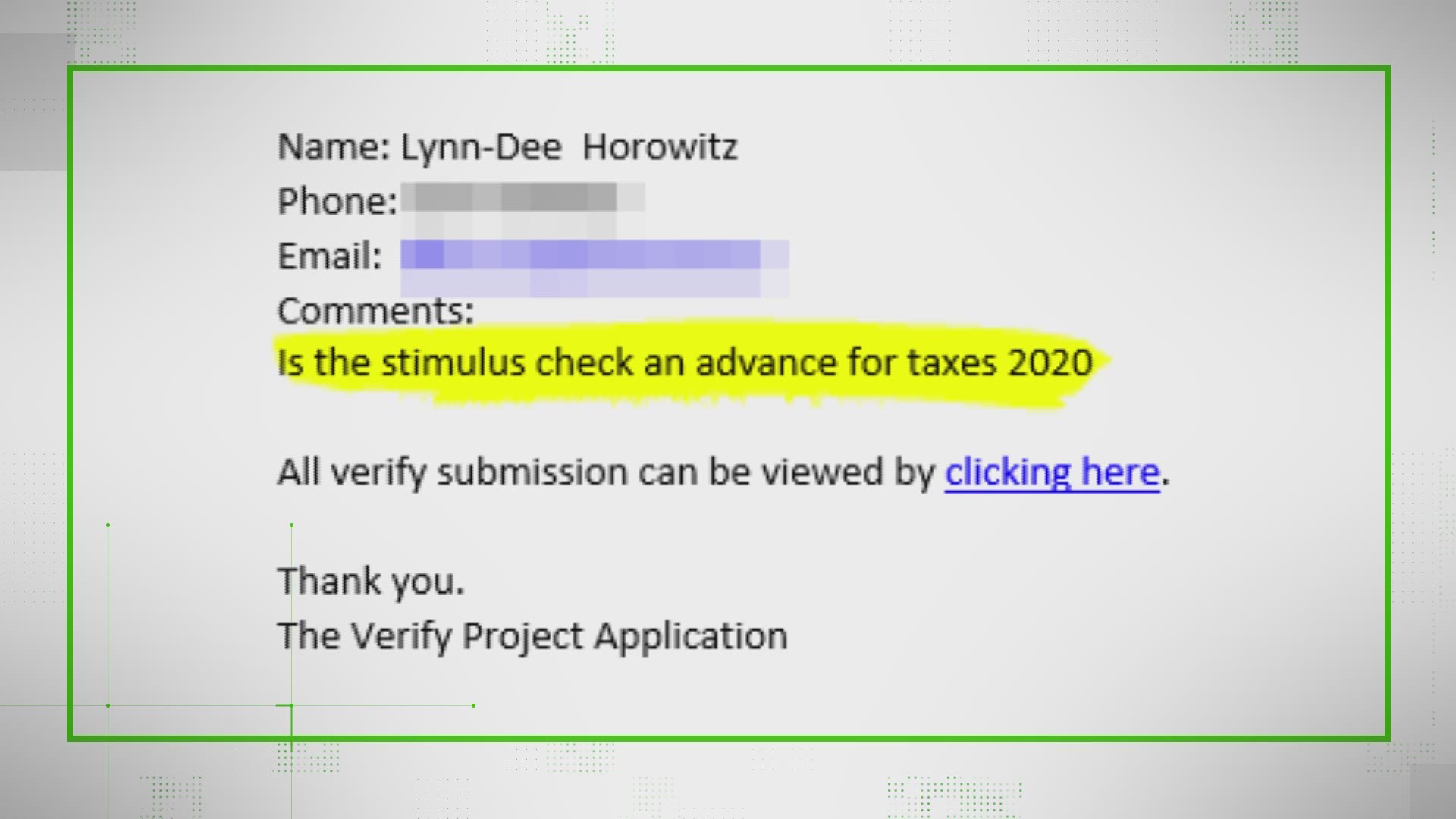

haven't filed taxes in 5 years will i still get a stimulus check

If you had a baby in 2021. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Stimulus Checks How Many Non Filers May Be Missing Out On Payment As Usa

Individual taxpayers who earn up to 75000 annually should expect to receive the full economic impact payment.

. Havent filed taxes in 5 years will i still get a stimulus check Monday March 14 2022 Edit. As we have previously recommended if you havent filed taxes in a long time you should consider two paths. Filing six years 2014 to 2019 to get into full compliance or four.

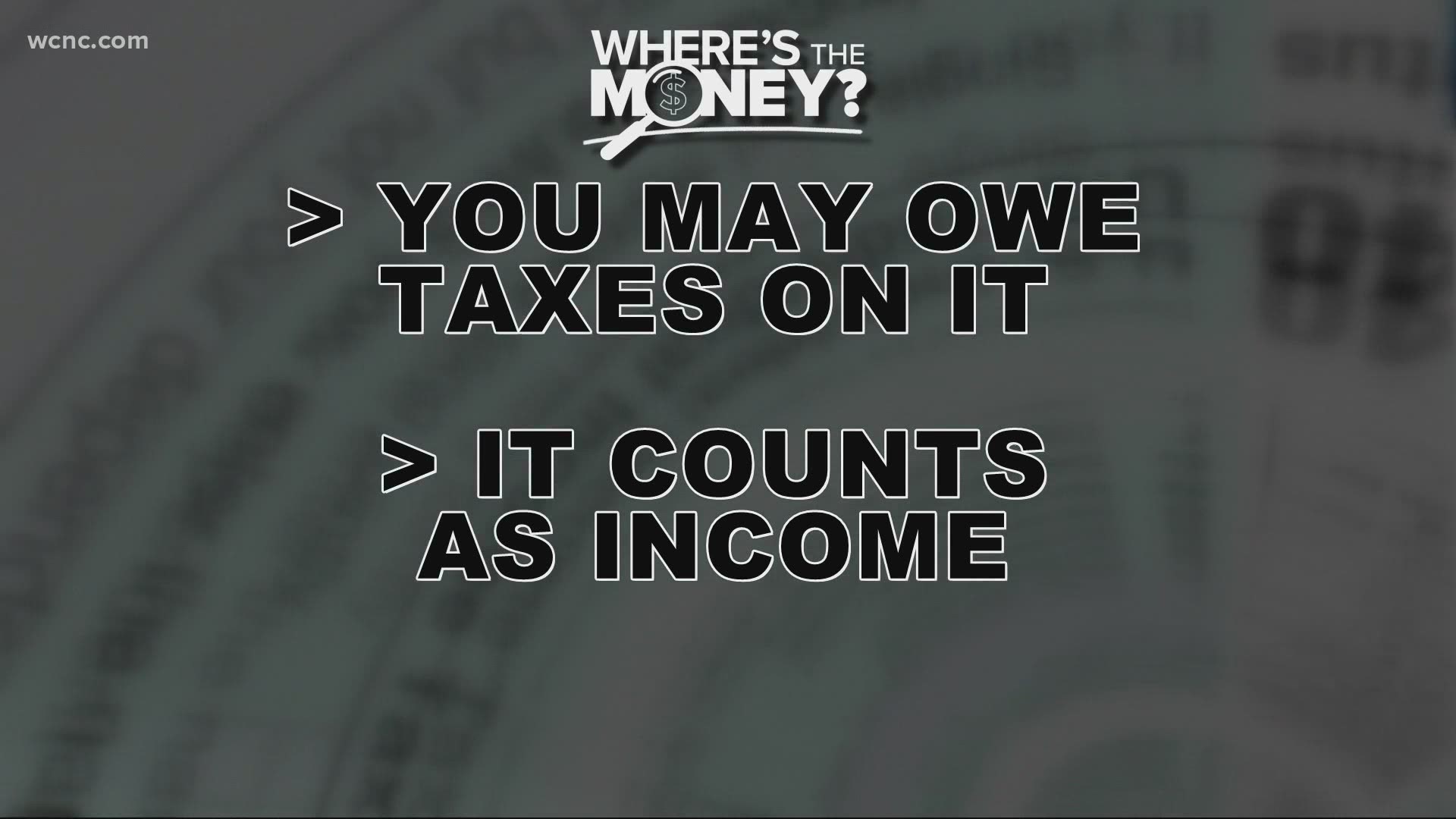

If the information Dependent SSN is correct you will need to removedelete the dependent in order to e-file the. The answer is no you wont be taxed on your stimulus money. Single taxpayers 65 years old or older have a threshold of 11950.

1200 sent in April 2020. On the other hand married couples who. Individual taxpayers with AGI of 80000 or more arent eligible.

Million People Who Dont Normally File Taxes This Year Will Most Likely Have To File In Order To Get Their Money From The Stimulus Checks. What happens if you dont file taxes for 5 years. You can review the information entered under the Basic Info tab Dependents.

The answer is no you wont be taxed on your stimulus money. Generally the IRS is not. Its too late to claim your refund for returns due more than three years ago.

33 minutes agoEnhanced child tax credit. You may need to file a tax return. Americans have been given a little bit longer to file their 2020 tax return.

Under the Internal Revenue Code 7201 any willful attempt to evade taxes can be punished by up to 5 years in prison and 250000 in fines. You may still be able to get a. You wont get a stimulus check if your adjusted gross income AGI is greater than.

However you can still claim your refund for any returns. Enhanced child tax credit. If you owed taxes for the years you havent filed the IRS has not forgotten.

If you failed to pay youll also have 12 of 1 failure to pay penalty per. 80000 if your filing status was single or. Havent Filed Taxes in 5 Years If You Are Due a Refund.

Who is not eligible for a stimulus check. The IRS and Treasury Department clarified this week that Social Security beneficiaries will not have to file a tax return in order to get their payments. The deadline for filing has been pushed back from April 15 to May 17.

If your adjusted gross income. Also a direct payment you get this year wont reduce your tax refund in 2021 or increase the amount you. Up to 3600 per child or 1800 if you received payments on a monthly basis in 2021.

The new stimulus check will begin to phase out after 75000 per the new targeted stimulus plan. Also a direct payment you get this year wont reduce your tax refund in 2021 or increase the amount you owe. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

If you are the head of the household then the threshold is 14950. In most cases the IRS is not going to pursue any criminal action when all that is needed is to file those prior year returns and pay any taxes owed. For each return that is more than 60 days past its due date they will assess a 135 minimum.

If you havent filed yet theyll use your 2018 tax return instead. Will You Still Receive Your Stimulus Check If You Haven T Filed Your Taxes 7 On. Sent in April 2020 for 1200.

For example if you didnt get a third stimulus check because you didnt file a 2019 or 2020 tax return you can still claim a payment when you file a 2021 tax return. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing.

Covid 19 Stimulus Payments And Public Benefits Work Without Limits

When Are 2020 Taxes Due Claiming Stimulus Checks May 15 Irs Wusa9 Com

What To Know About The Third Stimulus Checks Get It Back

California Sends Out 1 6 Billion In Stimulus Checks What To Do If You Haven T Received One

What To Do If You Still Haven T Gotten Your Stimulus Check East Idaho News

Never Got The 3rd 1 400 Stimulus Payment Here S What To Do When Filing Taxes Ktla

How To Get Your Stimulus Check Quickly

What To Do If You Haven T Received Your Stimulus Check Abc10 Com

Coronavirus Stimulus Check If I Haven T Filed Tax Returns In 2019 Or 2018 Am I Eligible Masslive Com

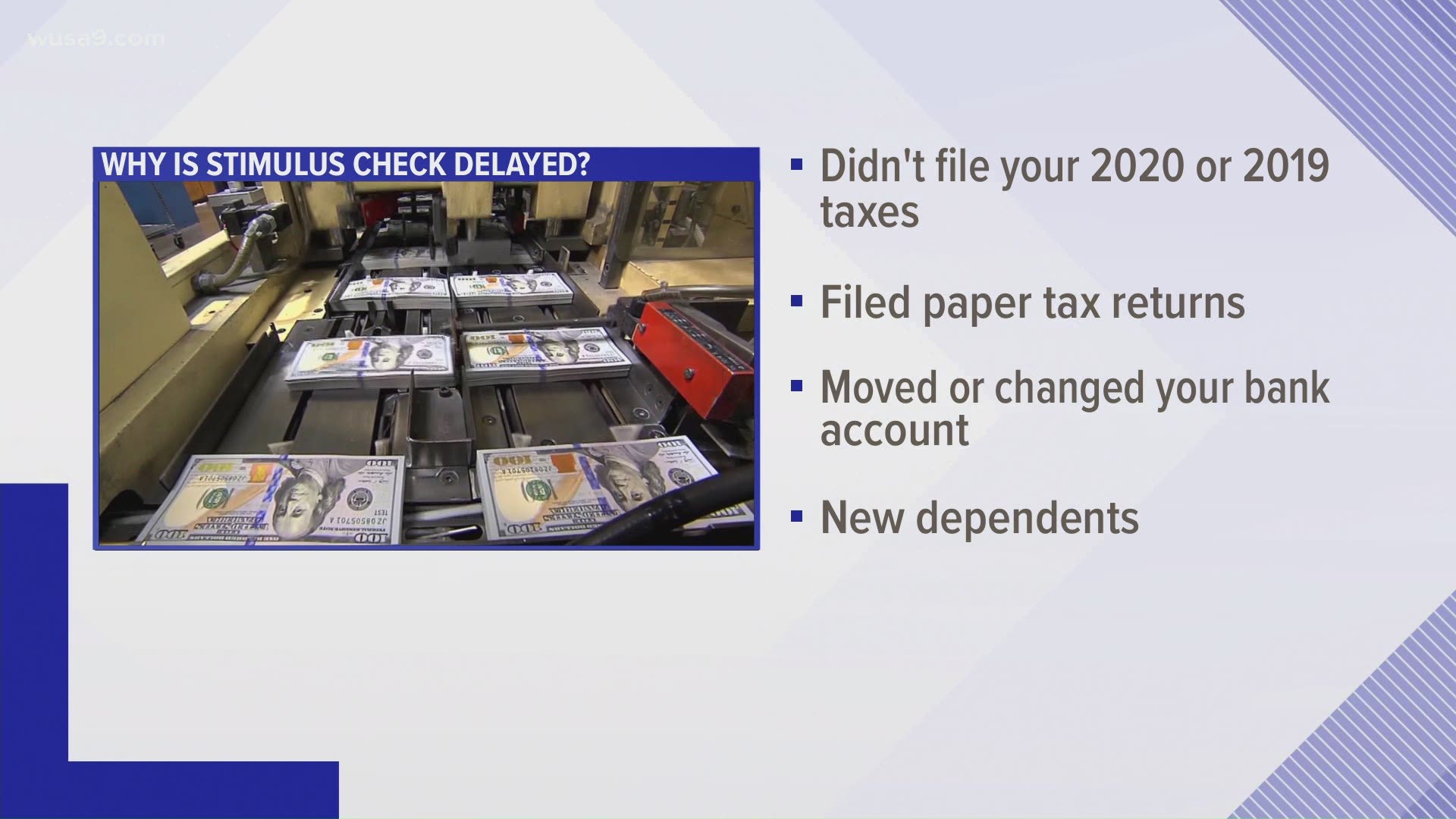

Haven T Received Your 2nd Stimulus Check Here Are 7 Possible Reasons Why Kiro 7 News Seattle

Coronavirus If You Didn T File Taxes Follow These Instructions Ksdk Com

600 Stimulus Check Didn T Get A Payment Or The Full Amount 10tv Com

Register For Your Stimulus Payment Free Easy Online Cares Act

Still Haven T Received Last Stimulus Here S What To Do

Stimulus Check 2020 Full Details About Emergency Taxpayer Aid

Irs Says Anyone Still Waiting For A Stimulus Payment Should Claim It On Their 2020 Tax Return The Washington Post

Where S My Stimulus Check How To Check If You Ve Gotten Your Money And How To Claim It If You Haven T Nowthis

Stimulus Checks How Do You Claim Missing Stimulus Money On Taxes King5 Com

Your 1 200 Stimulus Check How To Claim It Before It S Too Late Bankrate